🕒 Last updated on: November 25, 2025

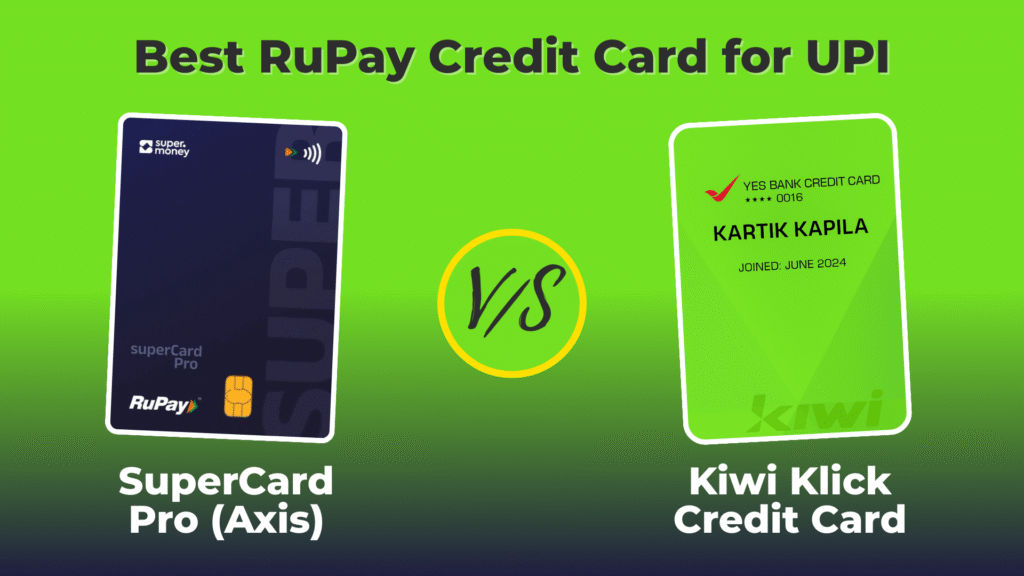

Kiwi vs SuperMoney: A Detailed Comparison

In the battle of cashback rewards on UPI payments, Kiwi vs SuperMoney has become the most talked-about comparison among UPI spenders. With RuPay credit cards now enabled for UPI, apps like Kiwi and SuperMoney are making everyday QR payments more rewarding than ever. But which one truly gives you the best return—unlimited cashback, extra perks, or better signup bonuses?

In this blog, we’ll break down the key features, cashback structures, and signup offers of both platforms to help you pick the smartest UPI credit card for your needs. Let’s dive into a detailed comparison to help you discover the Best RuPay Credit Card for UPI among the 2 popular options:

Kiwi Klick Credit Card vs SuperCard Pro (or Kiwi Credit Card vs SuperMoney Credit Card)

Disclaimer: This blog may include affiliate links. They help support our work but don’t affect product rankings/reviews. Our recommendations are based on unbiased evaluations & personal experience.

Table of Content:

Benefits of LTF RuPay Credit Card for UPI

Before we compare, let’s quickly understand the benefits of Lifetime Free RuPay Credit Card for UPI:

Convenience: No need to carry physical cards anymore! Link your RuPay credit card directly to any UPI app, and pay merchants via QR code scans.

Rewards & Cashback: Use your RuPay Credit Card for UPI spends and earn points/cashback on everyday transactions.

Lifetime Free: No joining/annual fees means you enjoy all the benefits of RuPay Credit Card without any recurring costs.

Better Rewards: Since the card is Lifetime Free, it eliminates the compulsion to hit annual spending milestones for fee waiver, allowing you to freely choose the card that offers the best rewards for any given purchase.

Boost Credit Score: Responsible usage helps build a strong credit history.

The Contenders: Kiwi vs SuperMoney

We have chosen the 2 most popular RuPay Credit Cards for UPI—Supercard Pro and Kiwi Klick Credit Card (SuperMoney vs Kiwi App) —because they are lifetime free, offers high cashback on UPI and have the best reviews for UPI-based rewards compared to other options like YES Bank POP or Rio Money.

Let’s dive into a detailed comparison to help you discover which RuPay Credit Card is the perfect fit for your spending habits.

Kiwi Klick Credit Card (Kiwi App)

Key Features:

- 1.5% Cashback on Kiwi UPI (Unlimited)

- 2-5% Cashback on UPI with Kiwi Neon Membership**

- 3 Airport Lounge Access (On spends of 50/100/150k*)

- Lifetime Free Card, Banking Partner: Yes Bank

- Referral Welcome Benefit: Rs 100-800

- Referral Code: Will Be Updated Soon!

- Monthly spend-based offers

With Kiwi Neon Membership (Cost Rs 999/year) You get:

- *Milestone Based Lounge Access: 3 Domestic Lounge Access are offered on spends of 50K, 100K and 150K.

- **2% base cashback on paying a merchant through QR Code and 3/4/5% cashback on spending 50K/100K/150K.

- Cashback on money transfers and Bill Payments

SuperCard Pro (Super.Money App)

Key Features:

- Flat 3% Cashback on superUPI (Rs 500/month)

- Flat 1% Cashback on Other Spends

- Lifetime Free Credit Card

- Free Physical Card

- Referral Welcome Benefit: Up to Rs 500 on Signup

- Exclusive Cashback Offers on OLA, Myntra, MMT and more

- Banking Partner: Axis Bank

- Flipkart occasionally promotes the super.money app and superCard Pro through discount and cashback offers.

- No Airport Lounge Access Offered.

- Up to 5% Cashback on superUPI

- Up to 5% cashback on Recharges and postpaid bills (10% additional cashback up to Rs 30 for Airtel Postpaid Payment)

The Final Comparison: Kiwi vs SuperMoney

*With Kiwi Neon Membership (Annual Cost 999+GST):

- Get 2% base cashback on Scan & Pay spends through Kiwi Klick Credit Card (via Kiwi App).

- Unlock 3/4/5% cashback on milestone spends of Rs 50K/100K/150K within a year.

- Unlock Domestic Lounge Access along with cashback at every milestone.

Otherwise, a flat 1.5% Cashback without Kiwi Neon Membership.

Kiwi Vs SuperMoney: Cashback Calculator

Kiwi Credit Card vs SuperMoney Credit Card: UPI Cashback Calculator

Cult Conclusion: Which One is Right for You?

Choosing the “best” RuPay credit card for maximizing cashback on UPI depends entirely on your priorities and spending profile:

Kiwi Klick Credit Card:

- This is a strong contender if you are a High UPI Spender.

- Primary goal is to get the highest possible cashback on UPI transactions with no monthly limit.

- Kiwi Klick Credit Card is a definite yes if you are comfortable paying the optional Rs 999 for the Kiwi Neon Membership, which grants a base 2% cashback and Milestone Cashback & Lounge Benefits.

- Note: Cashback is offered only if Scan & Pay or Merchant Payments are done through the Kiwi App.

SuperCard Pro:

- This is a strong contender if you are a Limited UPI Spender.

- The Supercard Pro is an excellent choice if your monthly Merchant Spends are up to Rs 16,666 as it provides straight 3% Cashback up to Rs 500/month without any spends criteria.

- Note: Cashback is offered only if Scan & Pay or Merchant Payments are done through the Super.Money App.

Both these options, Kiwi and SuperCard Pro, are reliable and offer the fundamental benefit of being LTF and RuPay-enabled for UPI, which is a game-changer for digital payments. Before applying, it is always recommended to check the latest terms and conditions, specific cashback rates, and ongoing offers before making your decision, as these can change frequently.

Keep Spending! Keep Saving!

We hope you liked our detailed comparison: Kiwi vs SuperCard Pro (or Kiwi vs Supermoney), the best RuPay credit card for UPI.

This review and comparison is based on my personal, ongoing experience using both the Kiwi App and Supermoney App, combined with the latest available market information.

We would also recommend you to read our recent post in which we compared: HDFC Tata Neu Infinity vs Plus Credit Card.

Discover more details about both the apps here: Kiwi App and Super.Money App.

Pingback: Best Credit Card for Movie Tickets | Lifetime Free Cards (Oct'25)

Pingback: Kiwi Referral Code | Signup Offer | 5% Cashback on UPI (Nov'25)

Pingback: Axis SuperCard Pro Cashback Update | Trick to Maximize Rewards (Effective 1st Jan'26) - Credit Cult